AROOSTOOK COUNTY, Maine — Increasing financial education and literacy is key to keeping us financial sound during all stages of life.

Offering local students, families and seniors in our communities with the benefits of financial literacy is underway in our credit union’s field of membership.

NorState FCU has been offering financial education to local students, starting in elementary classrooms all the way through Senior Colleges offered at UMPI and UMFK.

“We have educational materials and we are ready for presentations to all age groups.

Everything we present is customizable toward the demographics of the group from seminar materials, class curriculums, and presentations such as budgeting, financial basics, how to recognize fraud, understanding credit and how it impacts your finances; tips on how to buy a car or finance a mortgage, acquire a real estate loan, credit counseling and more, comments NorState’s Executive Marketing Director Denise Duperré.

We are busy scheduling financial literacy presentations to anyone who is in need of this personal or group service and it’s at no cost to them.”

With the lack of personal financial education in the past few decades, NorState FCU has increased their Financial Education efforts throughout the County and beyond.

“We are seeing an increased volume of fiscal irresponsibility in a certain generation because it was not a component of their upbringing or part of their education, added Duperre.

It’s not to say that everyone struggles at some point with finances. We just want to inform people that we are here to help them.

That’s our credit union philosophy, people-helping-people.”

Danielle Hebert, Marketing Coordinator for NorState and other staff presenters work with students and educators in local schools and organizations, to understand the basics and the complicated intricacies of financial information like Student Loans, understand credit scores and personal budgeting.

“It has been a pleasure working with NorState and Danielle who has been coming into my Personal Career Management class and speaking on topics of financial awareness, stated Madawaska High School Educator, Vickie Boucher.

It is reassuring to me, that what I am teaching is indeed on the right track to the real world for my students, and hearing the similar information from another adult who works in our community is beneficial to students as they prepare for the next chapter in their lives!”

NorState’s Financial Education efforts are for all ages and levels and the interaction between presenters and participants are encouraged through real life discussions.

- NorState’s Danielle Hebert recently held classes providing education and information about Identity Theft and how to recognize fraud to seniors who attended the fall session of Senior College at UMPI and UMFK. (Courtesy of Norstate FCU)

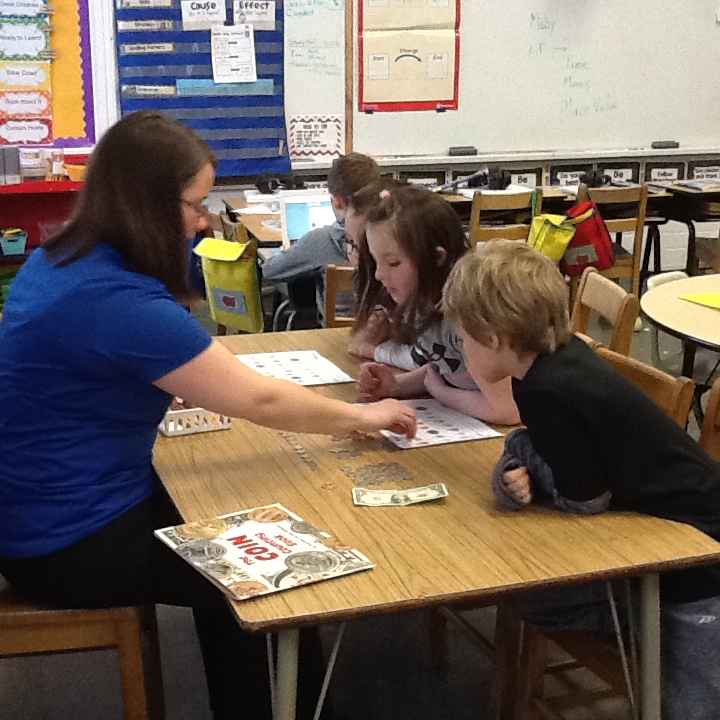

Younger students love the fun and games of discovering needs versus wants, and seeing the different currencies such as a half dollar, counting games, and learning about Saving-Spending-Sharing.

Our Saving-Spending-Sharing program we currently run with second grade students with 7 elementary schools participating in the program, allows us to connect with the students starting with International Credit Union Day tours in October, when educators bring the students to the credit union for a tour of operations.

“Young students are fascinated with operational things one would never get the opportunity to see such as how the ATM machine works; drive-thru tubes and transactions, inside the coin vaults, and the IT networking room with its miles and miles of cables to seeing the President’s office, adds Hebert.

Their curiosity at that age is a great way to make them understand the world of currency and how it becomes a part of living, no matter what age.”

NorState then follows students throughout the year by going into the classrooms when invited, to read books about spending or saving, and doing fun activities about Save-Spend-Share.

We also check in on their individual classroom “Sharing”projects where the teachers and children save with their NorState classroom coin safe given to them during the credit union tours.

This project allows the children to keep that connection with financial literacy throughout the winter months, which they save, have discussions on spending and how their concentrated efforts to save will help them Share to those less fortunate.

“We then combine all of their savings to donate to the Aroostook chapter of Special Olympics, comments Duperré.

“The classrooms challenge each other to see who can raise the most funds and the credit union will match a certain portion of the monies raised to add to their donation.

In April we finalize the year again during Youth Savers Week with tokens for all the children in appreciation of their financial educational year with the credit union, and recognize the top saver classrooms for their efforts.”

NorState also is a key participant in the Aroostook Chapters of Credit Union’s Financial Fitness Fair for all Junior classes who attend a half day workshop at Loring Job Corp about personal budgeting as a 22 year old recent college graduate entering the work force.

“NorState Federal Credit Union is owned and operated by members, adds CEO Susan G. Whitehead.

It is to everyone’s benefit to acquire good financial information and education to make good financial decisions every day.”

For more information about NorState’s Financial Literacy programs, call them at 1-800-804-7555 or visit them on their website, norstatefcu.org