MILLINOCKET, Maine – Getting Maine Land Use Planning Commission rezoning approval means more investment dollars for Canadian junior mining company Wolfden, according to company officials.

“If we were to get through rezoning, I expect our stock price to go up and that allows us to raise the $15 to $20 million to do the execution,” said Wolfden CEO Ron Little on Wednesday during the final day of the LUPC public hearings in Millinocket.

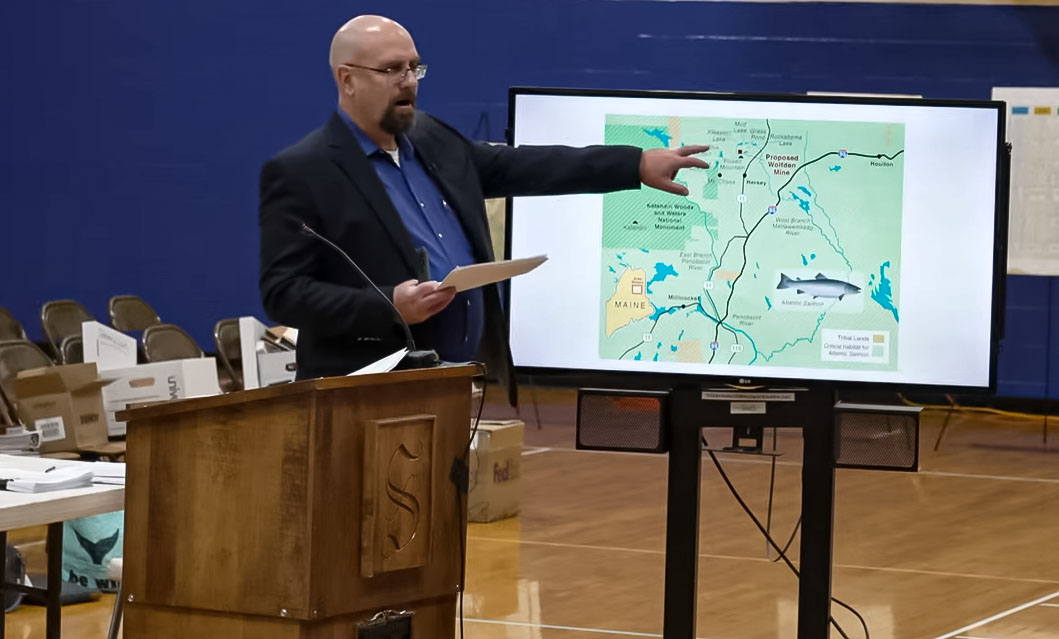

Wolfden is seeking LUPC rezoning approval for a 374-acre parcel in the unorganized territory near Mt. Chase and about nine miles from Patten. Approval opens the door for Wolfden to apply for a state mining permit and would test Maine’s strict mining laws.

The public hearings are part of the commission’s process to determine whether to approve Wolfden’s rezoning application.

Little said that larger mining companies have been watching the three days of public hearings that included expert testimony, cross examination and public comment. The Millinocket hearings concluded Wednesday morning, but an additional public comment period is slated for 6:30 p.m. Oct. 23 at the Cross Insurance Center, 515 Main St., Bangor.

“More companies would be exploring in Maine if the permitting process in Maine was easier,” Little shared with the commission. “This has been quite an elaborate affair that is a bit unusual in the mining industry.”

On Wednesday several commissioners asked Wolfden to clarify technical details related to the mine as well as the number of promised jobs, financial statements and the possibility of a Wolfden takeover by a larger mining company.

Wolfden Vice President Jeremy Ouellette said that it would be about four or five years before any jobs would be available to local residents and that during that time they hope to be training and recruiting. There will eventually be 230 jobs at the mine, he said.

“Then there would be a two-year construction phase and we would use local people for that,” he said.

Nonetheless, when the mine ramps up to full operation, experienced contractors would be hired for about two years while trainees learn the operation, he said.

Little explained that staying with the Pickett Mountain project is their hope because it is Wolfden’s flagship, but because shareholders own the company, he is at the mercy of a public market.

Junior mining companies go into a new jurisdiction and develop a great project and that’s usually when a bigger company comes along and makes an offer to buy them out, Little said.

Still, Little said he doesn’t expect a takeover until they make it through the state’s approval and permitting process.

“It’s likely going to be with a much bigger company and that might actually make [local] people more comfortable with the bigger balance sheet, bigger track record. That only adds to the socioeconomic benefits,” he said. “In allowing us to get through to the next stage, there will be other [mining] companies looking to come to Maine.”

LUPC Commissioner Leo Trudel said that a larger balance sheet could possibly add more credibility to the project.

Little pointed out that Kinross Gold Corp., a major Canadian mining company, is one of Wolfden’s biggest shareholders along with medium-sized mining company Altius Minerals.

During cross-examination, Attorney Peter Brann asked about the possibility of a Kinross takeover and whether they would have the same values and promises that Wolfden has made in their LUPC application.

“My simple thought on Kinross is that they are the same as we are,” Little said.

Brann pointed out that Kinross had over 3,000 violations in Washington state for violations of the Clean Water Act.

“Buckhorn Mountain is one of the unspoiled natural areas of our state,” Washington Attorney General Bob Ferguson said in a 2022 release about a Kinross mine. “These companies had a responsibility, and legal obligation to protect it. They failed in that responsibility, thousands of times.”

Additionally, the Dept. of Justice entered into a $45 million agreement with Kinross for the clean-up of the Upper Animas Watershed. a Colorado Superfund site. In 2015, the Kinross mine released millions of gallons of water, toxic metals and acidic waste into the river, negatively affecting the region’s agricultural and recreational tourism industries and the natural resources along the river, the DOJ said.

Little said he was not aware of Kinross’ connection to the Colorado superfund site.

On Wednesday, Dan Kusnierz, water resources program manager for the Penobscot Indian Nation, testified at length about the pristine quality of the water near the proposed mine, the number of Atlantic salmon, brook trout and other fish that have returned to the waters after extensive river restoration projects and the indigenous rights to the land and surrounding waters.

“All of the streams in the vicinity of the proposed mine are class A with some AA streams. Acid mine drainage can easily upset this fragile environment during the spawning season which could lead to the demise of these fisheries,” Kusnierz said. “This habitat represents the best chance for Atlantic salmon recovery in the United States.”

The proposed mine has a high likelihood of generating acid mine drainage and to allow a metallic mineral mine to be developed so close to these waters would put Atlantic salmon recovery efforts at risk, he said.

A Wolfden attorney did not cross examine Kusnierz, saying they agreed with his testimony.

The written public comment period closes on Nov. 2.